Open up Door Loans and doorstep hard cash lending have acquired popularity as hassle-free and versatile selections for people looking for quick monetary support. These types of lending providers let borrowers to entry funds without the need to experience the standard, generally prolonged, bank loan application processes connected with financial institutions or other massive fiscal institutions. Whilst the attraction of this sort of loans may lie in their simplicity and accessibility, it’s crucial to fully understand the mechanisms, advantages, and potential pitfalls before considering this sort of economic arrangement.

The principle driving open doorway loans revolves around giving effortless and quickly access to cash, usually with no want for in depth credit history checks or collateral. This can make these loans appealing to people who may not have the most beneficial credit rating scores or those that facial area economic difficulties. Contrary to standard financial loans that will consider times or perhaps weeks to become permitted, open doorway financial loans usually supply income into the borrower’s account in a make any difference of hours. This pace and advantage are two from the most important aspects contributing to your growing level of popularity of such lending services.

The process of applying for these loans is easy. Generally, borrowers require to supply simple personalized information and facts, proof of income, and bank specifics. Due to the fact open up doorway financial loans are generally unsecured, lenders take on a lot more possibility by not demanding collateral. As a result, the curiosity charges and charges linked to these loans are usually increased as opposed to standard lending selections. Though This may be a drawback, the accessibility and speed of funding frequently outweigh the upper charges For most borrowers in urgent economic circumstances.

Doorstep money lending, because the identify implies, requires the delivery of money on to the borrower’s residence. This services is designed to cater to Those people who prefer in-person transactions or people that may not have usage of on the web banking amenities. A consultant from the lending corporation will go to the borrower’s dwelling to hand in excess of the hard cash and, in many situations, obtain repayments on a weekly or regular monthly foundation. This personal touch can provide a sense of reassurance to borrowers, Specially individuals that might be wary of on the internet transactions or are a lot less familiar with digital monetary providers.

Even so, just one must consider the larger curiosity costs and charges usually linked to doorstep dollars lending. These sorts of financial loans are thought of higher-danger by lenders, provided that they are unsecured and that repayment collection depends greatly to the borrower’s capacity to make payments after some time. Therefore, the desire rates billed might be drastically larger than These of ordinary financial loans. Borrowers really should be cautious of the, since the comfort of doorstep cash lending may perhaps appear at a considerable Charge.

A different facet to contemplate will be the repayment overall flexibility that these loans offer you. Numerous open up doorway loans and doorstep cash lending expert services provide versatile repayment options, which may be valuable for borrowers who may not be in the position to commit to rigid payment schedules. However, this versatility might also lead to for a longer time repayment durations, which, combined with large fascination fees, may cause the borrower to pay considerably additional over the life of the mortgage than they originally borrowed. It’s essential to evaluate whether or not the repayment composition of such financial loans is really manageable and according to one particular’s economical problem before committing.

Among the important components of open doorway financial loans is their potential to accommodate folks with inadequate credit scores. Conventional banks frequently deny financial loans to These with less-than-best credit history histories, but open up door lenders often aim much more within the borrower’s current ability to repay in lieu of their credit score earlier. When this can be advantageous for those seeking to rebuild their monetary standing, it’s vital being aware of the pitfalls associated. Failing to fulfill repayment deadlines can even more injury 1’s credit history score and potentially bring about more critical economic issues down the road.

The acceptance approach for these loans is usually fast, with decisions manufactured within a several hours, and cash in many cases are obtainable exactly the same day or the subsequent. This immediacy will make these loans a lifeline for persons dealing with surprising charges or emergencies, such as automobile repairs, clinical expenditures, or other unexpected monetary obligations. Having said that, the convenience of usage of resources can sometimes cause impulsive borrowing, which could exacerbate money challenges rather then take care of them. Borrowers need to generally consider whether or not they genuinely want the financial loan and whenever they will be able to afford the repayments before proceeding.

An additional benefit of doorstep funds lending is it enables borrowers to acquire funds with no need to have to visit a financial institution or an ATM. This can be significantly beneficial for those who might reside in remote spots or have restricted entry to economical institutions. On top of that, some borrowers may possibly really feel extra comfy working with a agent in person, especially if they've got problems about dealing with economical transactions on line. The personal mother nature of your services can foster a more powerful connection among the lender along with the borrower, but it surely is critical to do not forget that the substantial price of borrowing stays a substantial thought.

You can find also a certain level of discretion associated with doorstep money lending. For people who might not want to reveal their economic scenario to others, the opportunity to take care of mortgage preparations from the privateness of their household could be pleasing. The personal interaction which has a lender agent may additionally offer some reassurance, as borrowers can explore any issues or issues directly with the person delivering the bank loan. This immediate interaction can sometimes make the lending approach experience much less impersonal than handling a faceless on the net software.

To the downside, the usefulness of doorstep dollars lending can in some cases bring about borrowers using out several loans simultaneously, especially if they obtain it challenging to maintain up with repayments. This could certainly make a cycle of financial debt that's challenging to escape from, specifically When the borrower is not really taking care of their funds meticulously. Accountable borrowing and a clear idea of the bank loan conditions are essential to prevent this kind of cases. Lenders may possibly give repayment programs that seem versatile, though the higher-interest costs can accumulate quickly, leading to a substantial credit card debt load after some time.

While open up doorway financial loans and doorstep hard cash lending give different Rewards, for instance accessibility, pace, and suppleness, they aren't devoid of their troubles. Borrowers really need to diligently assess the terms and conditions of such financial loans in order to avoid receiving caught in the financial debt cycle. The temptation of quick dollars can occasionally overshadow the prolonged-phrase monetary implications, particularly Should the borrower is not really in a powerful place to make well timed repayments.

Among the primary things to consider for just about any borrower should be the overall cost of the personal loan, which includes interest costs and any extra expenses. Whilst the upfront simplicity of such financial loans is pleasing, the actual amount repaid after some time may be noticeably better than anticipated. Borrowers have to weigh the immediate benefits of obtaining hard cash rapidly from the extensive-term economic impression, especially In the event the financial loan conditions increase more than numerous months or maybe decades.

Furthermore, borrowers should also concentrate on any likely penalties for late or missed payments. Quite a few lenders impose steep fines for delayed repayments, that may further more increase the full expense of the personal loan. This makes it much more essential for borrowers making sure that they have got a stable repayment prepare in position just before taking out an open up doorway bank loan or opting for doorstep cash lending.

Regardless of the probable disadvantages, you'll find scenarios where by open up door financial loans and doorstep income lending may be beneficial. For people who want usage of cash rapidly and would not have other feasible monetary solutions, these loans deliver an alternate that can help bridge the gap throughout complicated moments. The true secret is to employ these loans responsibly and assure that they are Section of a well-imagined-out financial tactic as opposed to a hasty conclusion driven by fast requires.

In some instances, borrowers may well find that these loans serve as a stepping stone to additional secure financial footing. By producing well timed repayments, persons can demonstrate monetary duty, which may strengthen their credit history scores and permit them to qualify For additional favorable loan terms in the future. Nevertheless, this final result is dependent greatly to the borrower’s capacity to take care of the personal loan correctly and steer clear of the pitfalls of high-desire personal debt.

It’s also truly worth noting that open up door loans and doorstep cash lending are often subject to regulation by financial authorities in many nations around the world. Lenders will have to adhere to selected pointers with regards to transparency, curiosity rates, and repayment conditions. Borrowers need to make certain that they are addressing a respectable and regulated lender to stay away from probable frauds or unethical lending practices. Examining the lender’s credentials and examining testimonials from other borrowers might help mitigate the potential risk of falling sufferer to predatory lending schemes.

In summary, open up door financial loans and doorstep income lending give a practical and accessible Resolution for people going through immediate money difficulties. When the ease of acquiring these financial loans can be desirable, it’s essential to technique them with warning and a clear knowledge of the affiliated costs and hazards. Borrowers really should cautiously Consider their capacity to repay the loan within the agreed-upon phrases and know about no refusal loans uk direct lenders the opportunity long-phrase economic outcomes. By doing this, they might make educated decisions that align with their monetary targets and stay away from the widespread pitfalls of substantial-fascination lending.

Angus T. Jones Then & Now!

Angus T. Jones Then & Now! Romeo Miller Then & Now!

Romeo Miller Then & Now! Alisan Porter Then & Now!

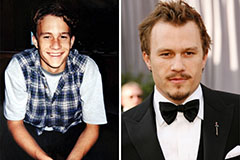

Alisan Porter Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!